Unlocking Potential: Bitcoin Price Surge Anticipated with Expected SEC Approval for Spot BTC ETFs

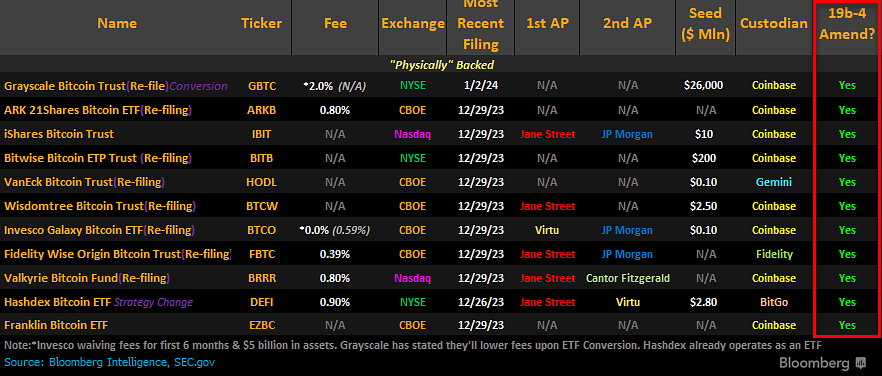

As the cryptocurrency market continues to evolve, all eyes are on the potential game-changer – the approval of Spot Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). Speculation is rife that this week could mark a significant milestone for Bitcoin, with the SEC poised to greenlight Spot BTC ETFs. Let’s delve into the implications and potential impact on Bitcoin’s price dynamics.

The SEC’s Critical Role: The SEC’s role in approving financial instruments tied to cryptocurrencies has been a pivotal factor in the market’s maturation. Spot Bitcoin ETFs, if approved, would provide a more direct way for institutional and retail investors to gain exposure to the cryptocurrency, potentially leading to increased adoption and mainstream acceptance.

Bitcoin’s Price Sensitivity: Bitcoin’s price has historically exhibited sensitivity to regulatory developments. Positive news from regulatory bodies, especially in a major financial market like the United States, tends to have a bullish effect. The anticipation of Spot BTC ETF approval has already stirred excitement within the crypto community, influencing trading sentiments.

Institutional Influx: The approval of Spot BTC ETFs could pave the way for institutional investors to enter the Bitcoin market more confidently. ETFs are well-known investment vehicles among traditional investors, providing a familiar and regulated avenue to access Bitcoin. This influx of institutional capital has the potential to drive demand and, subsequently, impact Bitcoin’s price positively.

Market Speculations and Volatility: As the SEC decision date approaches, the cryptocurrency market is likely to experience increased volatility. Traders and investors are closely monitoring developments, and any indication of SEC approval or rejection can trigger rapid market movements. It’s essential for market participants to stay informed and navigate these potential fluctuations strategically.

Broader Crypto Market Impacts: While the focus is on Bitcoin, the approval of Spot BTC ETFs could have broader implications for the entire cryptocurrency market. Positive sentiment towards Bitcoin often spills over to other major cryptocurrencies, influencing the overall market trend.

Final Thoughts: The potential SEC approval of Spot BTC ETFs is undoubtedly a crucial event for the cryptocurrency ecosystem. It signifies a step towards greater recognition and integration of digital assets into traditional financial markets. As the decision date approaches, market participants are bracing for potential shifts in Bitcoin’s price dynamics. Whether this approval becomes a catalyst for a sustained bull run or introduces new dynamics to the crypto landscape, it marks a significant chapter in the ongoing evolution of cryptocurrencies. Stay tuned for updates as the crypto community eagerly awaits the SEC’s decision and its potential impact on the future of Bitcoin.